Sindh Motor Vehicle Tax Comprehensive Guide 2025

The Sindh Government charges the Motor Vehicle tax on the registration, transfer of ownership, and Luxury vehicles. To comply with the requirements of vehicle ownership, it is necessary to get your car or motorcycle registered in your name. The Sindh government doesn’t allow unregistered vehicles and can seize motor cars or motorcycles if you don’t show them the valid registration documents. If you have registration documents, then you can also find your snatched or stolen vehicles. In order to get your vehicle registered, you need to pay the Motor Vehicle Tax, which is a one-time tax that is only paid while getting your vehicle registered. This article covers all the required Motor Vehicle Tax details you should know as a vehicle owner.

Sindh Motor Vehicle Tax

The Sindh Motor Vehicle Tax is a provincial tax levied on the ownership and use of motor vehicles registered within the Sindh province of Pakistan. Governed by the Sindh Motor Vehicle Taxation Act, 1958, and administered by the Excise, Taxation & Narcotics Control Department of Sindh, this tax is a key revenue source for the provincial government, funding infrastructure development, road maintenance, and public services.

Types of Motor Vehicle Tax in Sindh

A. Annual Tax

Payable yearly based on vehicle type, engine capacity, and usage:

- Private Vehicles: Calculated per engine capacity (cc) or horsepower.

- Commercial Vehicles: Based on seating capacity, load capacity, or vehicle type.

- Motorcycles/Scooters: Fixed annual tax rates.

B. One-Time Token Tax

For new vehicles, payable at the time of registration or transfer of ownership.

C. Lifetime Token Tax

An option for private vehicles to pay a lump sum for the vehicle’s lifetime, avoiding annual payments.

Rather than paying the Motor Vehicle Tax annually, citizens prefer a one-time payment so the Government collects as at the time of registration.

Motor Vehicle Tax Calculation and Rates

The fee payable at the time of registration for a vehicle is as follows

| a | Under 1000cc Motor car/Jeep | 1% of the vehicle value |

| b | Under 1300cc Motor car/Jeep and exceeding 1000cc | 1.25% of the vehicle value |

| c | Under 2500cc Motor car/Jeep and exceeding 1301 cc | 2.25% of the vehicle value |

| d | Motor Car/Jeep Exceeding 2500cc | 5% of the vehicle value |

| d (i) | Toyota Vigo/Revo/Tundra and other such double-cabin commercial vehicles | 4% of the vehicle value |

| e | Truck/Buses/Pickups/Rickshaw/Vans | 1.25% of the vehicle value |

| e (i) | Dumpers/Excavators/Cranes, including all other commercial vehicles (except Toyota Vigo/Revo/Tundra and other such double cabin vehicles) | 1.25% of the vehicle value |

| e (ii) | ii. Truck/ Dumpers / Water Tankers | 0.5% of the vehicle value |

| f | Motorcycles and scooters no more than 149 cc | 1% of the vehicle value |

| g | Motorcycle/Scooter 150 cc and above | 2% of the vehicle value |

| h | Tractor used for agricultural purposes | Rs. 2000/- |

Motor Vehicle Transfer of Ownership Fee

| S. No | Catogary of Vehicle | Fee |

| 1 | Motorcycle/Vehicle | Rs.500/- |

| 2 | Heavy Transport Vehicle (HTV) | Rs.4000/- |

| 3 | M/Cars, Jeeps, etc. upto 800 cc Engine Power | Rs.1600/- |

| 4 | M/Cars, Jeeps, etc. from 801 cc to 1,500 cc Engine Power | Rs.2,000/- |

| 5 | M/Cars, Jeeps, etc. from 1501 cc to 2,000 cc Engine Power | Rs.3,000/- |

| 6 | M/Cars, Jeeps, etc. from 2,001 cc to 3,000 cc Engine Power | Rs.5,000/- |

| 7 | Rickshaws | Rs.800/- |

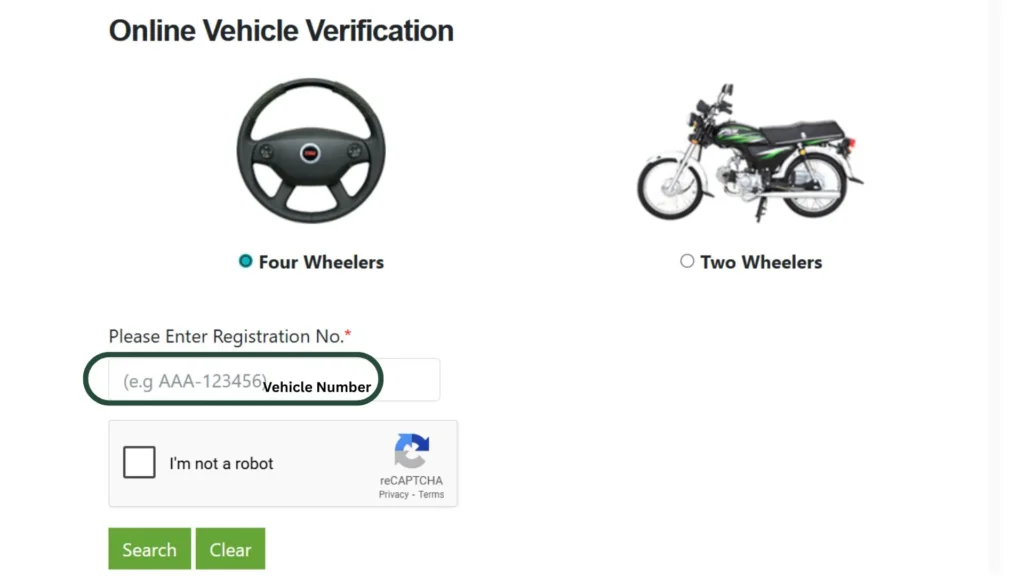

Check the Vehicle Ownership before purchasing any used vehicle.

Motor Vehicle Tax

| (a) | i) ii) | Motorcycle/Scooter not already registered not more than 149 ccMotorcycle/Scooter 150cc and above | Rs. 1800/- once for all Rs. 3000 once for all |

| (b) | Motorcycle/Scooter already registered and since first registration, the vehicle | ||

| i | Has not completed 5 years | Rs. 600/- once for all or Rs. 80/- per annum | |

| ii | Has completed 5 years but not completed 10 years | Rs.300/- once for all or Rs.80/- per annum | |

| iii | Has completed 10 years but not completed 15 years | Rs. 100/- once for all or Rs. 80/- per annum | |

| (c) | i | Motor cars/Jeeps etc (Non-Commercial) having engine capacity upto 1000cc not already registered | Rs.20000/-once for all |

| ii | Motor cars /jeeps etc (Non-Commercial) having engine capacity upto 1000 cc already registered having upto tax payment and since first registration the vehiclesa) Has completed 3 years but not completed 5 years | Rs.15,000 |

Luxury Vehicle Tax

| S no. | Category of Motor Vehicle | Rate of Fee |

|---|---|---|

| 1 | Imported motor Cars with the engine Capacity from 3000 CC & above | Rs.450,000/-. |

| 2 | Imported motor Cars with the engine Capacity from 2000 CC to 2999 CC | Rs.275,000/- |

| 3 | Imported motor Cars with the engine Capacity from 1500 CC to 1999 CC | Rs.100,000/- |

| 4 | Locally manufactured or assembled motor cars with engine capacity from 2000 CC and Above | Rs.50,000/-. |

| 5 | Locally manufactured or assembled motor cars with engine capacity from 1500 CC to 1999 | Rs.25,000/-. |

Note: The Tax information above authentic and is taken from the official Excise Sindh website.

Motor Vehicle Tax Payment Procedure

Steps to Pay Motor Vehicle Tax

- Visit the Excise & Taxation Office or authorized bank branches.

- Submit Required Documents:

- Original vehicle registration book (Log Book)

- Copy of owner’s CNIC

- Previous tax payment receipt (if applicable)

- Tax Calculation: The Official computes tax based on vehicle details.

- Payment: Pay via cash, bank draft, or online channels.

- Receipt & Sticker: Obtain payment receipt and current year’s tax sticker.

Penalties for Non-Payment of Motor Vehicle Tax

- Late Payment Fine: 10–25% of the due tax per month.

- Vehicle Impoundment: Possible seizure for prolonged non-payment.

- Legal Action: Prosecution under the Motor Vehicle Ordinance.

Importance of Paying Motor Vehicle Tax

- Legal Compliance: Avoid penalties and legal issues.

- Roadworthiness: A Valid tax is required for vehicle fitness certificates.

- Public Services: Contributes to road maintenance, safety, and infrastructure.

Exemptions and Concessions on Motor Vehicle Tax

- Vehicles owned by government departments (federal/provincial).

- Diplomatic vehicles (under international agreements).

- Disabled persons (special concessions).

- Electric vehicles (potential tax relief under green initiatives).

Recent Updates & Reforms

- Digitalization: Online tax payment, SMS verification, and e-stickers.

- Enhanced Recovery: RFID-based tracking and automated checkposts.

- Revised Slabs: Periodic revision of tax rates to match inflation and vehicle values.

Contact Information

Sindh Excise & Taxation Department:

- Website: excise.gos.pk

- Helpline: 1100

- Regional offices in Karachi, Hyderabad, Sukkur, Larkana, etc.

Conclusion

Paying the Sindh Motor Vehicle Tax is a mandatory legal obligation for all vehicle owners in the province. With digital systems streamlining the process, compliance has become more accessible. Stay updated with official notifications to avoid penalties and ensure smooth vehicle ownership.

Note: Tax rates and procedures may change. Always verify with the Sindh Excise Department for the latest information.